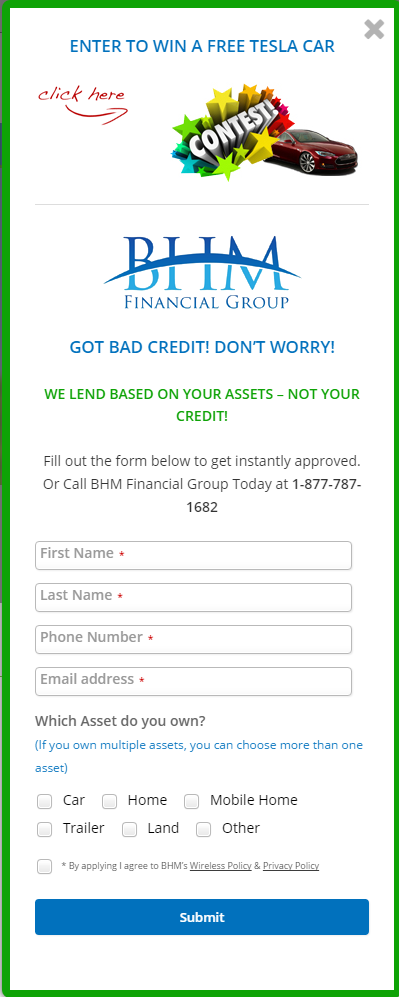

Get a bad credit secured personal loan now from BHM Financial, we help people get personal loans even with bad credit in Canada & make your dream a reality.BHM Financial Group providing bad credit loans in Canada, BHM is here to lend you up to $25,000 based on your assets, get your secured loan now.For more information visit : http://www.bhmfinancial.com/

Monday 29 August 2016

Thursday 25 August 2016

Secured Bad Credit Loans in Canada

If you live in Canada and you’ve been rejected for a loan by your bank or credit union because you are one of the people whose credit doesn’t meet their needs and you are now looking for a Bad credit loans, you can actually explore other possibilities that can help your debt problems, re-establish your credit, and get your money back on the good side.

If you have an emergency and need some money right now because you haven’t been able to save up any money for emergencies, then you may need to continue your search and find a company who can loan you the money. Personal loans when you have bad credit in Canada can have an interest rate of around 47%. If your credit isn’t too bad, you may be able to do better than this.

Risk

The amount of risk you take on when it comes to financial decisions can significantly impact your financial future. If you’re a risk-lover, you’ve probably taken out a line of credit, loan or some other form of a financial product. However, if you are risk-averse you’ve probably avoided this, resulting in no credit history and nothing on your credit report. It is safe to assume you have never borrowed money and have no experience paying back a debt, thus you haven’t done anything to establish a credit history or prove that you are financially responsible. When it comes to loans and credit, potential borrowers who have credit histories are often must more reliable and their approval rate is also often higher.

Last Resort

If you’re really struggling with your personal debt and need help, don’t extend the pain with a bad credit loan. Contact an accredited Canadian non-profit credit counselling organization today and get some help to get your finances back on track. The really good thing is that non-profit Credit Counsellors usually help people for free, and their help is completely confidential and typically non-judgmental. You have nothing to lose by talking to one. They are simply there to help.

In Canada, your credit score is a number between 300 and 900 that is assigned to you by a credit bureau (Canada’s two major credit bureaus are Equifax and TransUnion) and is used to tell lenders how you have dealt with available credit in the past. To check your credit score, you can either pay Equifax or TransUnion for a report plus your score, or you can sit down with a mortgage broker and get them to check it for free.

In Canada, your credit score is a number between 300 and 900 that is assigned to you by a credit bureau (Canada’s two major credit bureaus are Equifax and TransUnion) and is used to tell lenders how you have dealt with available credit in the past. To check your credit score, you can either pay Equifax or TransUnion for a report plus your score, or you can sit down with a mortgage broker and get them to check it for free.

If you have a credit score in the 600-700 range or above, you should be able to get a mortgage loan from one of the big Canadian banks, commonly known as the best lenders on the market.

Those who have taken out lines of credit, loans, or have credit cards understand the repayment process and are accustomed to working to pay off debts. Bad credit gives financial institutions information to work with, including understanding people’s habits and financial decisions.

Monday 22 August 2016

Secured Car Title Loans For Bad Credit

Car title loans are similar to payday loans in quite a few ways. Online payday loans became popular over the past decade and while it took a while it seems that car title loans are now nearly as prevalent online. Much like a payday loan, car title loans typically come with high interest rates. Car title loans offer you quick cash — often between 100 CAD and 10,000 CAD — in exchange for your vehicle’s title as collateral. They’re a type of secured loan, one backed by property the lender can take if you don’t pay.

Typically personal loans in Canada aren’t all that big. However, one way to get around that is to secure your loan against your vehicle, trailer, RV, boat or other assets. It’s also a great way to acquire a loan if you have a poor credit rating.

A car title loan works much in the same way as a regular installment loan. The difference is that the loan itself is secured against your vehicle. The lender takes title on your vehicle to secure himself against the potential risk of you defaulting on your loan.

If you have a low credit score then a car title loan is probably the easiest way to obtain a loan. Your weak financial profile is offset by the fact that the loan is secured, and as such, your application will appear far less risky to the lending officer who is reviewing your file.

A private loan works just like a bank loan. Similar to any regular loan from a bank, a private loan is a loan from a private institution or individual. It is a loan from a private lender as opposed to one of Canada’s chartered financial institutions.

Loans are easily doable if you have a good credit score and a down payment, but if you are missing one of the two it is not the end of the world. Loans Canada has a track record of success in finding loans for individuals in situations like these.

Standard car title lenders:

- Don’t check for credit.

- Don’t have to require proof of financial income.

- Need the car to be owned outright.

- Can ask that borrowers leave a key or install a GPS tracker or a remote immobilizer — all of which make cars easier to find again.

- Can repossess and sell the car, then charge the borrower fees for the repossession and storage. If the car sells for more than what’s owed, some states don’t ask the lender to repay the borrower the leftover.

While their interest rates are lower than those of payday loans, which can have APRs upward of 1,000%, car title loans’ interest rates are by no means low. Thirty-six percent APR is generally considered the upper range of “affordable.” The fees and cyclical borrowing associated with Car title loans make them even more expensive. Since payday loans and auto title loans are advertised as viable loans you must realize these are high cost.

Thursday 18 August 2016

Applying for a Loan With Bad Credit Online

When your credit is less than satisfactory, it can be difficult to find a lender willing to give you a personal loan. That doesn’t mean it’s impossible to find one – there are more options available now than ever before to get a personal loan with bad credit. What’s better is you can easily apply online to see the rates for which you qualify.

Does it mean that they give a loan to anyone who asks for one, without any restrictions? Does it mean that they are willing to give credit loans with no credit check? Most likely, it isn’t. Every single lender wants to do so only to people that he thinks will have the capability to repay. If so, and if loans are not given to anyone without restrictions, the question is: What is meant by ‘Bad Credit Loans’?

They each have lower credit thresholds and none rely solely on your score when deciding to lend to you, making it easier to qualify.

When a person begins his economic life (it can be when he reaches the age of maturity, or, it could be after migrating to a new country, where he is not known), he starts with a clean slate. There is no information about him in the local public databases – for better or for worse. This that means financial institutions will operate based on their belief and trust in the person. For example, a bank may agree to open a bank account for him, but will not rush to give him a credit card. If he is given a credit card, the bank would limit the amount of credit he receives. The bank would first want to see how he conducts his financial affairs before trusting him again.

Credit Score

Even though you might have a poor credit score, your actual credit history may not be that bad. Your credit file could be thin because you didn’t start building any credit until now, or maybe you’ve only ever had one open line of credit. Whatever the reason, just because your score is low doesn’t mean you’re not creditworthy, and these lenders know that.

Your credit score is heavily influenced by the amount of debt you have accumulated that has been paid off as well as your successful payment history. By being approved for a short term loan, every successful payment is a baby step towards growing your credit score.

It can be easy to think that because your score is low, you’ll be approved for a less than ideal interest rate, but you shouldn’t accept the first offer that comes your way.People may need a little extra cash for a number of reasons, but one of the most common reasons for needing a short term loan is to keep up with ongoing expenses, such as phone bills, rent or even credit card payments. When these bills are not paid in due time, they can negatively affect your credit.

Wednesday 17 August 2016

Bad Credit Secured Loans Canada

When life throws us an unexpected curveball, sometimes we all need a little help. Our first move is to get a credit loan, but we all know that this is a huge mistake. Credit loan companies tend to have an annual interest rate averaging 400%. These companies will prey on people that don’t have access to traditional credit.

Applying

When you’re applying for a loan, make sure the lender is pulling a soft inquiry. Your local credit union should be your first stop for a personal loan, because credit unions offer flexible loan terms and lower interest rates than online lenders for those with Bad credit loans. The maximum annual percentage rate at a federal credit union is 18%.

Bank financing has become far less common than it was previously for businesses. Why? Despite improvements with the economy, banks are still reluctant to lend money, particularly to those with poor or no credit. And, there are more options than ever for getting a loan with bad credit loans that don’t rely as much on your credit rating.

More than 50% of all business owners get some financing help from friends or relatives. More than likely, these people want to see you succeed in your venture, and a few might be willing to help finance it. This is a good alternative to bad credit loans, which are generated by companies.

Grants

There are both government and private grant programs available to businesses. Of course, there is fierce competition for this type of funding, but it’s worth a shot. Many of these programs are focused on particular industries, geographic areas, or certain types of business owners, such as women and minorities. There are other types of freebies that might be worth exploring, as well, such as free office space, business plan assistance, and more that can help reduce the cost of starting a business.

The term “origination fee” can be twisted. Some lenders may call this a service fee. No matter what the name is, be certain that you look at your rates and terms in great detail.

Score

You will pay more for credit than someone with a better score has to pay. But even the highest rate from lenders, standardly a 36% annual percentage rate, is a minimum part of what might be charged by lenders that don’t do credit at all. Those loans — no-credit-check installment loans and credit loans that are repaid in a couple of weeks — may carry APRs over 1,000% and it’s easy to become a victim in a debt cycle. You have many ways to avoid that, but it’s still good to be careful.

Here’s a pro tip when looking for a personal loan. The web is flooded with lead generating companies. For example, when you do a quick search for “bad credit loans”, you’ll see a mixture of direct lenders and lead generators. A lead generator basically collects your information and matches you with a lender. The problem with this is that you’ll have a handful of emails and phone calls coming in for the next week.

Wednesday 27 July 2016

Tuesday 26 July 2016

BHM Financial Provides Bad Credit Secured Loans Canada

However, our focus is for Secured Loans; with these loans, the interest rates are fairly lower than that of the unsecured. Some may be wary to take out a secured loan, mainly because of the collateral and their fear for losing it all. With the BHM Financial Group

Secured and Unsecured Bad Credit Loan

Both secured and unsecured bad credit loans are typically accessible. Be that as it may, secured loans are less demanding to search. Financing cost on secured bad credit loans can be higher than standard financing cost, yet this is may not be the situation dependably. In the event that the estimation of security you give is altogether higher than the loan amount, offered financing cost might be not exactly the standard rate.

Email: info@bhmfinancial.com

Phone: +1 (866) 733-5023

URL: http://www.bhmfinancial.com

Sunday 17 July 2016

Bad Credit Car Title Loans BHM Financial

BHM Financial Offers Personal Loans, Cash Loans and Bad credit loans, Car title loans, mortgage Loans with fast approval. Apply Now Online http://www.bhmfinancial.com/apply-now/

Tuesday 12 July 2016

Apply Now on Bad Credit Personal Loans in Canada

Find guaranteed bad credit loans in Canada BHM Financial Offers $1,000 Personal Loans, Cash Loans and Payday Loans, Car title loans, mortgage Loans. Get a bad credit secured personal loan now from BHM Financial, we help people get personal loans even with bad credit in Canada and make your dream a reality.For more information visit : http://www.bhmfinancial.com/

Wednesday 22 June 2016

Loans For Bad Credit

Bad Credit! It's like a having an itch that won't stop itching! A constant, nagging reminder that you're not in a good financial state; however today I come bearing the remedy for the financial discomfort bad credit can cause.

When youcannot financially cope with a particular situation, there are specific loans in place to ease the distress. For instance, you want to buy a house, you can apply for a Mortgage loan; you want to set up your own business? Apply for a business loan. Although these loans do assist in you getting what you want at the moment, there is a serious risk of falling into the deeper waters of financial struggle. How? With Interest rates! The longer you take to pay, the more what you are owing increases. What then comes out of that, is what we started this article with; BAD CREDIT!

Now, remember we discussed earlier about there being specific loans in place to help alleviate your financial distress? Well the remedy for the pain that is Bad Credit, is simply a Loan for Bad Credit.

Now there are two main types of Loans for bad credit:

1. Secured Loans, these are loans with which you sign up personal assets as some form of collateral, in the event you cannot maintain repayments.

2. A Guarantor Loan, which is basically an unsecured loan. You sign up without any applying any personal assets as collateral, however you must in fact have a Co - Signer on the loan. The Co-Signer must have a good credit score and cannot be financially linked to you (i.e Spouse). This however should be an arrangement that is discussed in its entirety so that both parties understand the risks involved.

There are many institutions that offer these type of Loans, but we at BHM Financial Group stand by our word to ensure you're out of financial distress when you apply with us. Our car title loans are quick and the amounts range from $1,000 to $25,000. This fact is what separates us from other financial groups in Canada.

So get ready to kiss your financial woes goodbye. Never again will you have to worry about financial trouble nor lose sleep over the frustration it causes.

Let us at the BHM Financial Group help you get back to enjoying your life and back to your best. Your financial security is nowour priority! Our goal isn’t to trick you so we do our business transparently. We will walk you through the entire procedure step by step to make sure you fully understand loan acquisition. Moreover, the repayment plans we create for each client are customized and personalized to cater the client’s needs.

If you're ready to retake control of your financial life, contact us Today, let's get to that simpler and faster solution to your life’s struggles.

Contact name: Rebecca Schwartz

Email: info@bhmfinancial.com

Phone: +1 (866) 733-5023

URL: www.bhmfinancial.com

Friday 17 June 2016

Get A Loan With Bad Credit

Credit. Now, I'm pretty sure you've heard the term before; although it may be more linked to advertisements intendedfor and exalting the persons holding Good Credit; it mayeven be your personal situation; none the less, it is most certainly a term you're familiar with.

The media does a fine job at helping those who have good and fantastic credit, get more comfortable in their lifestyles, so today I want to focus on and also extend a helping hand to those who have been stuck in a financially overwhelmingrut; those of you who most definitely cannot get a loan anywhere else due to poor credit, and are in dire need of a rescue!

You need not look any further, because I have the information you need! Now firstly you may be wondering, how is it even possible to get a loan with bad credit?! The way things work today, loans are a common necessity for the majority of people. We take loans when we want to maintain our lifestyle and live normally and maintain a healthy balance between our needs and wants. Problem is, MOST of those loans are geared toward people with good credit only. With the looming stigma of having bad credit attached to your name, it could seriouslyaffect the comfort of living your life will then take, and the avenues you could take to try to change your situation. If you're at that place and would like to know how to get a loan, the answer is quite simple really, you can apply for a Personal Loan; also known as a Bad Credit Loan. These loans in particular are geared toward assisting persons who are neck deep in financial responsibilities or even debt/bankruptcy. They can even be a clever way to consolidate your high in erest rate balances into one manageable monthly fixed rate and payment.

To qualify for a Bad Credit Loan is fairly easy. There are of course, certain necessary forms of documentation you must produce in order for the application can be verified. So, the sooner you do, the sooner your application can be confirmed.

We at the BHM Financial Group, connect on a realistic level with each client. We ensure you know without a doubt, that we not only understand your frustration, but seek to removeit and give you back your financial security! Our company is indeed one of the best in Canada. Why? Not only is there simplicity in applying with us, but our loaning system will secure bank statements that can improve your credit score! Therefore, making you eligible for better loans with us in the future.

Don’t wait until it’s too late! Get rid of your financial burdens! The BHM Financial Group is your financial partner that will offer solutions to your every problem. Give us a call today to get your loan and payment plan and make the first step towards your financial security.

Contact name: Rebecca Schwartz

Email: info@bhmfinancial.com

Phone: +1 (866) 733-5023

URL: www.bhmfinancial.com

Sunday 5 June 2016

Secured Loans For People With Bad Credit In Canada

It is very important to be made knowledgeable of the types of loans available to persons with poor credit or bad credit loans in Canada. There are Secured and Unsecured loans. By definition, a secured loan is a loan in which the borrower offers up any of their personal asset(s) (e.g. a car or property) as collateral for the loan. This in turn, becomes a secured debt owed to the creditor of the loan. In the event that the borrower defaults or fails to repay, the creditor is them liable to take possession of the asset(s) used as collateral. They are then at liberty to sell it to regain some or all of the amount originally loaned to the borrower; for example, foreclosure of a home. If the sale of the collateral does not equal to the total amount of money credited to pay off the debt, the creditor can often seek out a deficiency judgment against the borrower for the remaining amount owed.

Then there are unsecured loans, or Guarantor Loans. With these type of arrangements, the Creditor doesn't accept any collateral from the borrower, under the condition that they get someone who has good credit and is in no way financially linked to them to Co-sign on the agreement. Guarantor loans are often seen as alternatives to the payday loans. They are also associated with the subprime finance industry, as they mainly aimed at people who have no credit score; due to them eitherhaving never obtained credit in the past, or people with a damaged credit score, as a result of having missed too many payments towards debt in the past.

However, our focus is for Secured Loans; with these loans, the interest rates are fairly lower than that of the unsecured. Some may be wary to take out a secured loan, mainly because of the collateral and their fear for losing it all. With the BHM Financial Group, you can put your worries and concernsto rest. We are a one of the top Canadian-based loaning systems that gives everyone the possibility of getting a loan, regardless of the previous credit score. The amount of money that will be approved to the clients, would be based on their assets, not their credit score or history.

You see, there comes a point in everyone’s life when they need some financial assistance. When you’re in debt and can’t make your payments in time, the Car title loans can be the answer to your prayers. What separates us from other financial groups in Canada, is the fact that our car title loans are quick and the amounts range from $1,000 to $25,000. To take more stress off your back, the loan can be repaid in the period that ranges anywhere from two to five years! Our payment plans even include a 30-day return policy so you can repay your loan in the period that suits your schedule best!

We at BHM Financial Group put you and your financial needs at the forefront, so contact us for a simpler and faster solution to your life’s struggles.

Contact name: Rebecca Schwartz

Email: info@bhmfinancial.com

Phone: +1 (866) 733-5023

URL: www.bhmfinancial.com

Thursday 2 June 2016

Bad Credit Personal Loans Online

In order to feel secure in life, we feel like the money is what we need. And indeed, money can buy you a lot of things. Financial security is something we all strive for. Without it, we feel stressed, anxious, and even depressed because we can’t provide the essential things for ourselves and our families. The problem then arises when you've been labeled as having bad credit and can no longer dig yourself out of the financial pit you're in. That's where a Bad credit personal loans can truly come in handy for you.

With the ever growing technological age, things have just become even easier! One can do any and almost everything online/digitally. You don't have to leave your home to apply or even get approved for your loan.

Now, I can trulyunderstand why you may be adamant toward making such a life altering decision online, due to possiblethreats to your security, within such a vast space of codes and algorithms; however, I can assure you that there is a place you can legitimately apply, without the nagging fear of greater financial ruin.

With the BHM Financial Group, we put you and your needs at the forefront; therefore, your financial security is of optimum importance to us. Advances in technology has allowed us the ability to secure ourWebsites and to minimize the threats stemming from human interference. So when it seems like you're stuck between a rock and a hard place, know, without a doubt, that we at the BHM Financial Group will help you get back on track with our result certifiedapproach! Moreover, the repayment plans we create for each client are customized and personalized to cater the client’s every needs; the plans could range anywhere from 2 to 5 years for repayment.

Even if you're in a serious rut and need to get Cash approval quickly, our car title loans are our fastest approved loans; the amounts can range anywhere from $1,000 to $25,000! It's this fact that sets us apart from every other institution in Canada. Understand, that with the BHM Financial Group, the quick and easiest fix for ALL your financial troubles is but a click away!

If you genuinely desire to change your financial situation today, then we at the BHM Financial Group would be the financial partner that offers solutions to your every problem; we can make your dreams come true, whatever they are: your dream house, starting up your own business, a newcar/boat or the newest gadget(s) to treat yourself. We won't hesitate to cater to your needs, so give us a call today to set up your loan and payment plan and make the first step towards reclaiming your financial security and cementing its stability.

Email: info@bhmfinancial.com

Phone: +1 (866) 733-5023

URL: www.bhmfinancial.com

Tuesday 31 May 2016

Bad Credit Loans in Canada

What is Bad Credit? As self explanatory as the term is, let's delve in a bit deeper by answering questions like, "What is Credit Exactly?, What makes it Bad?" and "What is a Bad Credit Loan?".

So let's begin; Credit by definition, is simply your ability to get something of value in your possession, WHILE given the option to pay for it at a later date (most times with included interest).

Sounds like a good enough deal, no? Well, It could be once you don't take advantage of the privilege. You see, when trusted with great financial power, great financial responsibility is also very necessary. However, there are those who end up in situations where their repayment timeliness is poor (due to the loss of a job or unrelenting financial burdens), non existent (they simply couldn't care enough to bother to repay) or they may have even defaulted on a loan. There are in fact many ways one can get to the point of bad credit, but i listed only the ones that I deem impact your credit score the harshest. There are those who may retort, "Well, bad credit isn't all that bad. As long as I don't take any loans, I'll be fine!". Really? With the unpredictability of life, one should never take a financial chance so drastic!

If you are on a path where you would seriously like to change your credit situation, I'll let you know, there is in fact a way out. HOW?

I'm so glad you asked, there is something called a Bad Credit Loans. Yes, it's a personal loan available to those who in a short, have poor credit history. These loans in particular can help you re-establish/establish a good credit scoring.

Now that I have your interest peaked, I will also tell you where you can acquire one!

BHM Financial Group is a Canadian-based loaning system that gives everyone the possibility of getting a loan, regardless of your previous credit score. Our system is designed to assist in advancing funds to approved clients and to ensure that every one of our customers are financially stable. The steady loaning schedules and operations guarantee that your needs will be taken care of. The amount of money that will be approved to the clients is based on mainly their assets, not their credit score or history.

The advances we offer can help you pay off student loans and mortgages as well as provide you the funds to make investments. In addition, our loaning system will secure bank statements and it can improve your credit score so you can get better loans in the future. We can make your dreams come true, whatever they are: your dream house, ideal business, a sports car or the new phone you’ve been drooling over since it was announced. So no need to worry about your financial burdens, let us take them from you and give you back your life!

Contact Name: Rebecca Schwartz

Email: info@bhmfinancial.com

Phone: +1 (866) 733-5023

URL: www.bhmfinancial.com

Thursday 19 May 2016

Are You Having Financial Problems? Do You Require Assistance But Can’t Seem To Find A Loan?

In order to feel secure in life, we feel like the money is what we need. And indeed, money can buy you a lot of things. Financial security is something we all strive for. Without it, we feel stressed, anxious, and even depressed because we can’t provide the essential things for ourselves and our families. If you’re in debt and you feel like there’s no way out, there’s still something you can do. The future doesn’t have to be so depressing. All you have to do is find the right loan. The way things work today, loans are a common necessity for the majority of people. We take loans when we want to maintain our lifestyle and live normally and maintain a healthy balance between our needs and wants.

BHM Financial Group is a Canadian-based loaning system that gives everyone the possibility of getting a loan, regardless of the previous credit score. This system is designed to assist in advancing funds to approved clients and to ensure every customer is financially stable. The steady loaning schedules and operations guarantee that your needs will be taken care of. The amount of money that will be approved to the clients is based on their assets, not their credit score or history.

The advances we offer can help you pay off student loans and mortgages as well as provide you the funds to make investments. In addition, our loaning system will secure bank statements and it can improve your credit score so you can get better loans in the future. We can make your dreams come true, whatever they are: your dream house, ideal business, a sports car or the new phone you’ve been drooling over since it was announced.

Now you can finally kiss your worries goodbye. Never again will you have to worry about financial trouble. When it seems you’ve hit rock bottom, we at the BHM Financial Group will help you get back on track. Your financial security is our priority! Our goal isn’t to trick you so we do our business transparently. We will walk you through the entire procedure step by step to make sure you fully understand loan acquisition. Moreover, the repayment plans we create for each client are customized and personalized to cater the client’s needs.

Don’t wait until it’s too late! BHM Financial Group is your financial partner that offers solutions to your every problem. Give us a call today to get your loan and payment plan and make the first step towards financial security.

There comes a point in everyone’s life when they need some financial assistance. When you’re in debt and can’t make your payments in time, the car title loans can be the answer to your prayers. We believe the car title loans need to be fast and help you solve any financial problems that strike.

What separates BHM Financial Group from other financial groups in Canada is the fact that our Car title loans are quick and the amounts range from $1,000 to $25,000. The loan can be repaid in the period that ranges anywhere from two to five years. With BHM Financial Group, the quick and easy fix for all your financial troubles is just a click away! Our payment plans include a 30-day return policy so you can repay your loan in the period that suits your schedule best. Here at BHM Financial Group it’s all about what works for you! Contact us for a simpler and faster solution to your life’s struggles.

Contact name: Rebecca Schwartz

Email: info@bhmfinancial.com

Phone: +1 (866) 733-5023

URL: www.bhmfinancial.com

Sunday 24 April 2016

Bad Credit Loans Canada

Bad Credit Loans can be utilized for some reasons. For instance, on the off chance that you have couple of unpaid obligations, you can utilize them for obligation union, which is relatively simpler to oversee in light of the fact that obligation combination typically gives lower loan cost thus bring down portions. You can diminish your obligation at lesser expense. Bad obligation individual loans can be utilized with the end goal of training, occasion, home change, vehicles and so on.

It is bad-okay. In any case, entryways are not shut for you. You can even now search for Bad Credit Loans. There is uplifting news for you. Bad credit loans are presently getting affirmed.

If there should arise an occurrence of bad credit, bad credit loans take care of your monetary issues as well as allow you to enhance your credit records.

Searching Bad Credit Loan

At time, it is conceivable that the lender will comprehend your circumstance, on the off chance that you have fallen into bad credit net. Money related world has created to such a degree, to the point that the lenders have loan complimenting every single conceivable circumstance of borrowers. Furthermore, bad credit loans are not any exemption. There are great conceivable outcomes that they will have individual loans complimenting your circumstance. Be that as it may, the distinction in the event of bad credit loan might be as higher financing costs or additional security or maybe a couple portions as initial installment.

Secured and Unsecured Bad Credit Loan

Both secured and unsecured bad credit loans are typically accessible. Be that as it may, secured loans are less demanding to search. Financing cost on secured bad credit loans can be higher than standard financing cost, yet this is may not be the situation dependably. In the event that the estimation of security you give is altogether higher than the loan amount, offered financing cost might be not exactly the standard rate. Unsecured bad credit loans for the most part have financing cost higher than that of secured bad credit loan. The repayment generally spread from 6-10 years. The repayment period likewise rely on the motivation behind the loan.

Loan Amount

Ordinarily, the most extreme amount of loan if there should be an occurrence of secured bad credit is accessible up to $25,000 with the greatest repayment time of 6 years. With secured bad credit individual loans, the lender lends you the money based on your asset. Be that as it may, for this situation, lenders are most agreeable in paying the loan comparable to 85-100% of property estimation unless there is critical need of more loans.

Borrowed, money is not your calling but rather loaning money is the occupation of those lenders thus they are specialists in the field, particularly in credit evaluation. In this manner, never attempt to shroud any data. Individual circumstances ought to be obviously exhibited keeping in mind the end goal to discover suitable loan for bad credit. Normally loan lenders depend on credit scoring to get some answers concerning bad credit. In this way, knowing your credit score is fundamental. The better your score is the better rates you get for bad credit loans. Indeed, even two focuses lesser from your past score can spare thousands as far as money. Lawfully, you have a privilege to get any false data remedied. Reasonable credit reporting act permits you to get any false bad credit data redressed. Credit score is utilized to recognize bad credit.

Searching Bad Credit Loans

Searching the best bad credit loans may appear a strenuous undertaking, in the first place. You can search bad credit loan offices through daily paper promotions or by utilizing a web search motor, for example, Google or yippee. While searching, use wide terms to search. In any case, such terms ought to be either excessively expansive or excessively slender.

Searching through web program has extra point of preference of looking at terms and states of various lenders on the web. In a matter of couple of minutes one can search the best lender taking into account his criteria

Caution

Bad credit loans are for crises and ought not to be utilized time and again!

One approach to abstain from requiring bad credit payday loans is to spare a smidgen of your consistent paycheck every week. Regardless of the possibility that it's 10 dollars, it will include and can be utilized as a part of crises rather than a payday loan.

Subscribe to:

Posts (Atom)